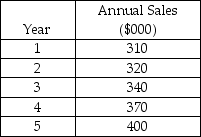

Table 6.4

Mr.Lee is considering a capacity expansion for his supermarket.The annual sales projected for the next five years follow.The current capacity is equivalent to $300,000 sales.Assume a 20 percent pretax profit margin.

-Using the information in Table 6.4,if Lee expands the capacity to an equivalent of $360,000 sales now (year 0) ,how much would pretax cash flow in year 5 increase because of this expansion?

A) less than $7000

B) more than $7000 but less than $10,000

C) more than $10,000 but less than $13,000

D) more than $13,000

Correct Answer:

Verified

Q60: If a system is well balanced,which one

Q61: Table 6.5

The T.H.King Company has introduced a

Q62: Table 6.2

High Tech,Inc.is producing two types of

Q63: Table 6.2

High Tech,Inc.is producing two types of

Q64: Table 6.3

The North Bend Manufacturing Company is

Q66: Table 6.3

The North Bend Manufacturing Company is

Q67: Table 6.4

Mr.Lee is considering a capacity expansion

Q68: Table 6.6

Burdell Labs is a diagnostic laboratory

Q69: The Northern Manufacturing Company is producing products

Q70: Innovative Inc.is experiencing a boom for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents