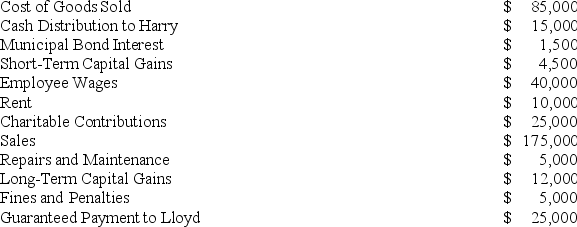

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: On January 1, X9, Gerald received his

Q73: What is the difference between the aggregate

Q75: If partnership debt is reduced and a

Q82: Jordan, Inc., Bird, Inc., Ewing, Inc., and

Q84: Lincoln, Inc., Washington, Inc., and Adams, Inc.

Q86: On June 12, 20X9, Kevin, Chris, and

Q88: In each of the independent scenarios below,

Q88: ER General Partnership, a medical supplies business,

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents