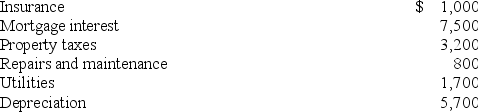

Tyson owns a condominium near Laguna Beach, California. This year, he incurs the following expenses in connection with his condo:

During the year, Tyson rented the condo for 100 days, receiving $25,000 of gross income. He personally used the condo for 60 days. Assuming Tyson uses the Tax Court method of allocating expenses to rental use of the property. What is Tyson's net rental income for the year (assume this is not a leap year)?

During the year, Tyson rented the condo for 100 days, receiving $25,000 of gross income. He personally used the condo for 60 days. Assuming Tyson uses the Tax Court method of allocating expenses to rental use of the property. What is Tyson's net rental income for the year (assume this is not a leap year)?

Correct Answer:

Verified

Se...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Alison Jacobs (single) purchased a home in

Q99: Several years ago, Chara acquired a home

Q100: Jasper is looking to purchase a new

Q101: Kristen rented out her home for 10

Q102: Alfredo is self-employed and he uses a

Q103: Careen owns a condominium near Newport Beach

Q104: Ashton owns a condominium near San Diego,

Q107: Don owns a condominium near Orlando, California.

Q108: Rayleen owns a condominium near Orlando, Florida.

Q123: Mercury is self-employed and she uses a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents