Bulldog Supplies Ltd has an item of equipment that has a carrying value of $80,000. For taxation purposes the asset's net value is $60,000 and deferred tax liabilities of $3,000 had previously been recorded. Bulldog also has accrued interest revenue of $5,000 that will not be taxed until it is received in cash. The tax rate is 30 per cent. What is the journal entry to record the tax effect?

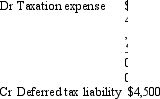

A)

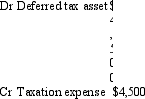

B)

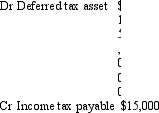

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q22: Under AASB 112's approach to accounting for

Q25: Sinfonia Ltd made credit sales for this

Q26: Snifful Industries has a depreciable asset that

Q35: Digitor Industries Ltd accrues long service leave

Q38: The correct method for calculating the amount

Q39: A deferred tax asset arises if:

A) The

Q42: The carrying amount of deferred tax assets

Q43: Recognising deferred tax assets and deferred tax

Q43: Shopping Malls Ltd has some land it

Q44: As at 30 June 2007, Net Accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents