Shopping Malls Ltd has some land it purchased several years ago for $300,000. It has revalued the land this period to $480,000 and management intends to sell it in the near future. When the land was acquired the index for capital gains tax was 110 and at reporting date it is 132. The tax rate is 30 per cent. What is the entry to record the tax implications of the revaluation?

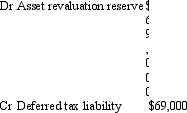

A)

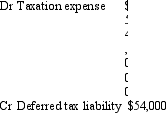

B)

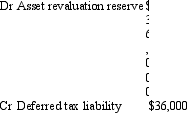

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q26: Snifful Industries has a depreciable asset that

Q30: The criteria for recognising a deferred tax

Q38: The correct method for calculating the amount

Q39: Bulldog Supplies Ltd has an item of

Q42: The carrying amount of deferred tax assets

Q43: Recognising deferred tax assets and deferred tax

Q44: As at 30 June 2007, Net Accounts

Q48: Lesser Ltd is wholly owned by Moore

Q52: Which of the following statements is not

Q55: To be a member of a "tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents