As at 30 June 2007, Net Accounts Receivables was $57,000, and the Allowance for Doubtful Debts was $3,000. On 30 June 2008, the respective balances were $64,000 and $4,000. Assuming there were no other temporary differences, what s the journal entry to adjust for the changes in these balances as at 30 June 2008? The corporate tax rate is 30 per cent.

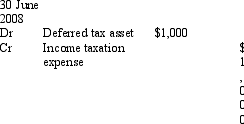

A)

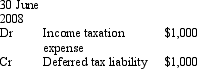

B)

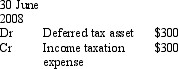

C)

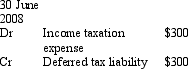

D)

E) None of the given answers

Correct Answer:

Verified

Q30: The criteria for recognising a deferred tax

Q38: The correct method for calculating the amount

Q39: Bulldog Supplies Ltd has an item of

Q42: The carrying amount of deferred tax assets

Q43: Shopping Malls Ltd has some land it

Q43: Recognising deferred tax assets and deferred tax

Q46: The transfer of tax losses to other

Q48: Lesser Ltd is wholly owned by Moore

Q52: Which of the following statements is not

Q55: To be a member of a "tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents