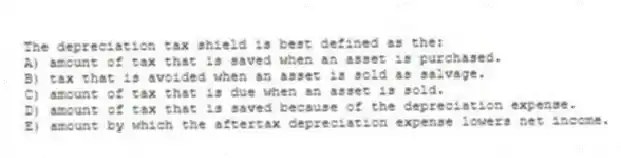

The depreciation tax shield is best defined as the:

A) amount of tax that is saved when an asset is purchased.

B) tax that is avoided when an asset is sold as salvage.

C) amount of tax that is due when an asset is sold.

D) amount of tax that is saved because of the depreciation expense.

E) amount by which the aftertax depreciation expense lowers net income.

Correct Answer:

Verified

Q19: Changes in the net working capital requirements:

A)

Q20: GL Plastics spent $1,200 last week repairing

Q21: Which one of the following will increase

Q22: Which one of the following is a

Q23: Dexter Smith & Co. is replacing a

Q25: Three years ago, Knox Glass purchased a

Q26: The bottom-up approach to computing the operating

Q27: Increasing which one of the following will

Q28: The operating cash flow of a cost-cutting

Q29: The current book value of a fixed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents