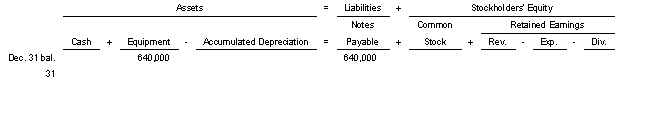

On January 2 2002 equipment with a cost of $640000 was purchased in exchange for a note.The equipment has an estimated salvage value of $60000 and an estimated life of 12000 hours.It is to be depreciated by the units-of-activity method.Use the following tabular analysis to determine the adjustment that would be made for depreciation for the first full year if the equipment was used 3000 hours.

A) Increase Accumulated Depreciation and decrease Depreciation Expense by $160000.

B) Decrease Equipment and Notes Payable by $160000.

C) Decrease Equipment and increase Depreciation Expense by $145000.

D) Increase Accumulated Depreciation and Depreciation Expense by $145000.

Correct Answer:

Verified

Q210: On July 2 2022 equipment with a

Q211: On August 7 Gideon Ridge Restaurant purchased

Q212: On January 2 2022 Feldman Corporation sold

Q213: Equipment was purchased for $85000 on

Q214: A company has the following assets:

Q215: On October 10 Givens Retail purchased a

Q216: During 2022 Hernandez Company incurred $1900000 of

Q218: On December 1 2022 Daylilly Company purchased

Q219: On July 1 2022 Dylan Company purchased

Q220: On January 2 2022 Dabney Company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents