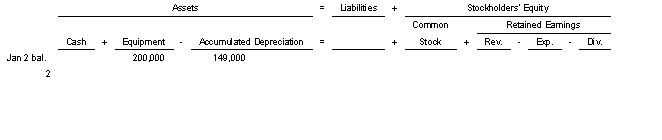

On January 2 2022 Feldman Corporation sold equipment with a book value of $51000 for $33000 cash.Use the following tabular analysis to record the sale.

A) Increase Cash $33000 decrease Equipment $200000 decrease Accumulated Depreciation $149000 and decrease Revenues $14000.

B) Increase Cash $33000 decrease Equipment $200000 and decrease Accumulated Depreciation $149000.

C) Increase Cash $33000 decrease Equipment $200000 decrease Accumulated Depreciation $149000 and increase Expenses $14000.

D) Increase Cash $33000 decrease Equipment $51000 and increase Expenses $14000.

Correct Answer:

Verified

Q207: On January 2 2022 Dabney Company purchased

Q208: On July 1 2018 Graunke Company purchased

Q209: Plant assets are ordinarily presented in the

Q210: On July 2 2022 equipment with a

Q211: On August 7 Gideon Ridge Restaurant purchased

Q213: Equipment was purchased for $85000 on

Q214: A company has the following assets:

Q215: On October 10 Givens Retail purchased a

Q216: During 2022 Hernandez Company incurred $1900000 of

Q217: On January 2 2002 equipment with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents