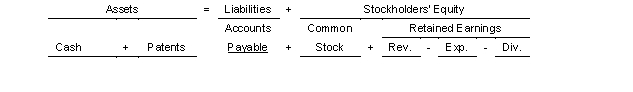

On July 1 2018 Graunke Company purchased a patent from Chimney Rock Company for $8000000.It was estimated that the patent has a remaining useful life of 4 years.On July 1 2022 Graunke retired the asset.Use the following tabular analysis to make the adjustment for retirement assuming that the cost has been fully amortized.

A) Increase Expenses and decrease Patents $2000000.

B) Decrease Patents and increase Expenses $1000000

C) Increase Revenues and decrease Patents $8000000.

D) The Patent account would have a zero balance so no entry would be needed.

Correct Answer:

Verified

Q203: On Nov 2 2020 MG Company purchased

Q204: During 2021 Hogan Company incurred $2100000 of

Q205: Carnival Corporation purchased a limousine for $185000

Q206: On January 2 2022 High Country Corporation

Q207: On January 2 2022 Dabney Company purchased

Q209: Plant assets are ordinarily presented in the

Q210: On July 2 2022 equipment with a

Q211: On August 7 Gideon Ridge Restaurant purchased

Q212: On January 2 2022 Feldman Corporation sold

Q213: Equipment was purchased for $85000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents