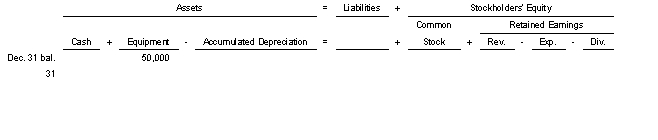

On July 2 2022 equipment with a cost of $50000 was purchased for cash.The equipment has an estimated salvage value of $6000 and an estimated life of 4 years.It is to be depreciated by the straight-line method.Use the following tabular analysis to determine the adjustment that would be made for depreciation for 2022 assuming the company has a calendar year end.

A) Increase Accumulated Depreciation and decrease Depreciation Expense by $11000.

B) Decrease Equipment and increase Depreciation Expense by $11000.

C) Decrease Equipment and increase Depreciation Expense by $5500.

D) Increase Accumulated Depreciation and Depreciation Expense by $5500.

Correct Answer:

Verified

Q205: Carnival Corporation purchased a limousine for $185000

Q206: On January 2 2022 High Country Corporation

Q207: On January 2 2022 Dabney Company purchased

Q208: On July 1 2018 Graunke Company purchased

Q209: Plant assets are ordinarily presented in the

Q211: On August 7 Gideon Ridge Restaurant purchased

Q212: On January 2 2022 Feldman Corporation sold

Q213: Equipment was purchased for $85000 on

Q214: A company has the following assets:

Q215: On October 10 Givens Retail purchased a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents