Pierce Manufacturing owns all of the outstanding voting common stock of Sylvia Company,as acquired several years ago when the book values and fair values of Sylvia's net assets were equal.

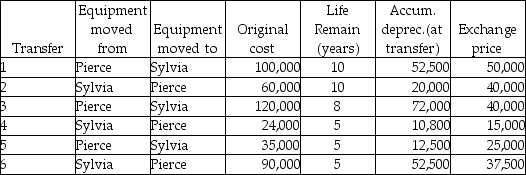

In 2013,Pierce set out to re-structure the company,and in doing so,re-aligned the manufacturing processes to streamline the use of automated equipment.As a result,they set out to move certain equipment around between the facilities owned by both Pierce and Sylvia,and ultimately agreed on the following transfers and exchange prices.It was agreed that the exchange price would be paid in cash on January 1,2014,the date the equipment was transferred.Straight-line depreciation is used and the different pieces of equipment have no salvage value.

Required:

1.Prepare the journal entry that Pierce would record for each transfer listed.

2.Prepare the journal entry that Sylvia would record for each transfer listed.

3.Prepare the consolidation worksheet entries that would be required as a result of the above transactions for 2014.

Correct Answer:

Verified

Q26: Pollek Corporation paid $16,200 for a 90%

Q28: Prey Corporation created a wholly owned subsidiary,Sage

Q29: Plower Corporation acquired all of the outstanding

Q32: On January 1,2013,Pilgrim Imaging purchased 90% of

Q32: Snow Company is a wholly owned subsidiary

Q33: Separate income statements of Plantation Corporation and

Q34: Park Incorporated purchased a 70% interest in

Q34: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q35: Several years ago,Peacock International purchased 80% of

Q36: Palmer Corporation purchased 75% of Stone Industries'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents