Palmer Corporation purchased 75% of Stone Industries' common stock on January 2,2012.On January 1,2013,Stone sold equipment to Palmer that had a net book value of $16,000 and an original cost of $24,000 for $20,000.On January 1,2013,Palmer sold a building to Stone that had a net book value of $200,000 and an original cost of $250,000 for $300,000.The equipment had a remaining useful life of 8 years,and the building had a remaining useful life of 20 years.Neither asset had salvage value.Both companies use straight-line depreciation.

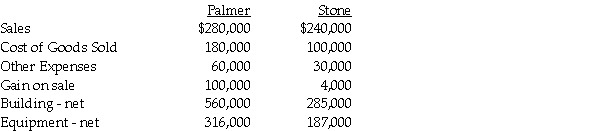

Selected account balances are shown below for Palmer and Stone for the year ended December 31,2013:

Required:

1.Prepare the consolidating working paper entries relating to the equipment and building for the year ended December 31,2013.

2.Calculate the following balances for the year ended December 31,2013:

A.Consolidated "Other Expenses"

B.Consolidated Buildings

C.Consolidated Equipment

D.Noncontrolling interest in Stone's net income

Correct Answer:

Verified

Requirement 2

A.Consolidated Other Exp...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: On January 2,2014,Pal Corporation sold warehouse equipment

Q29: Plower Corporation acquired all of the outstanding

Q31: Pierce Manufacturing owns all of the outstanding

Q32: Snow Company is a wholly owned subsidiary

Q32: On January 1,2013,Pilgrim Imaging purchased 90% of

Q33: Separate income statements of Plantation Corporation and

Q34: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q35: Several years ago,Peacock International purchased 80% of

Q38: Piglet Incorporated purchased 90% of the outstanding

Q39: Several years ago,Pilot International purchased 70% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents