On January 1,2013,Pilgrim Imaging purchased 90% of the outstanding common stock of Snapshot Productions for $585,000 cash.The remaining 10% of Snapshot had an assessed fair value of $65,000 at that time.Snapshot had equipment that was undervalued on their books by $50,000,and an unrecorded patent with a fair value of $15,000.The equipment had five years remaining to its useful life,and the patent had 10 years remaining to its useful life.

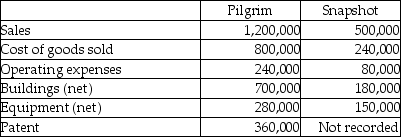

On January 1,2014,Pilgrim sold Snapshot a building for $100,000 that had originally cost $140,000.The book value was $60,000 at the date of transfer,and had a five-year remaining life at the date of transfer.Straight-line depreciation is used with no salvage value.Several line items from the companies' separate December 31,2014 trial balances are shown below.

Required: Determine consolidated balances for each of the accounts listed as of December 31,2014.

Correct Answer:

Verified

Q28: Prey Corporation created a wholly owned subsidiary,Sage

Q29: Plower Corporation acquired all of the outstanding

Q31: Pierce Manufacturing owns all of the outstanding

Q32: Snow Company is a wholly owned subsidiary

Q33: Separate income statements of Plantation Corporation and

Q34: Park Incorporated purchased a 70% interest in

Q34: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q35: Several years ago,Peacock International purchased 80% of

Q36: Palmer Corporation purchased 75% of Stone Industries'

Q39: Several years ago,Pilot International purchased 70% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents