Account balances are as of December 31, 20X3 except where noted.

Additional Information:

Additional Information:

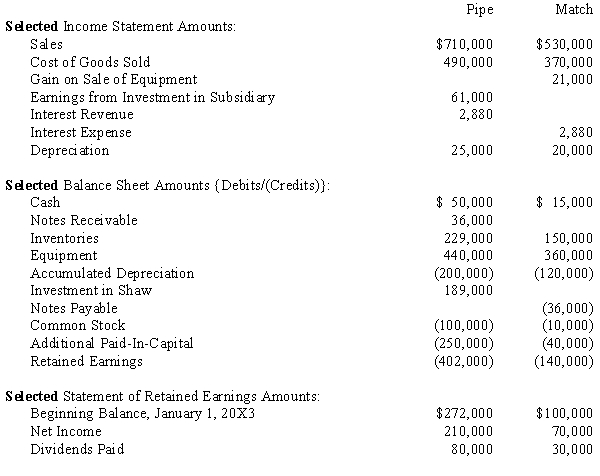

On January 2, 20X3 Pipe purchased 90% of Match for $155,000. On that date Match's shareholders' equity equaled $150,000 and the fair values of Match's assets and liabilities equaled their carrying amounts. Excess, if any, is attributed to patents and is amortized over 10 years.

On September 4, 20X3 Match paid cash dividends of $30,000.

On January 3, 20X3 Match sold equipment with an original cost of $30,000 and a carrying value of $15,000 to Pipe for $36,000. The equipment had a remaining useful life of 3 years. Straight-line depreciation is used.

On January 4, 20X3 Match signed an 8% Note Payable. All interest payments were made as of December 31, 20X3.

During the year Match sold merchandise to Pipe for $60,000, which included a profit of $20,000. At year end 50% of the merchandise remained in Pipe's inventory.

Required:

1.Which method is Pipe using to account for the investment in Match? How do you know?

2.What elimination entry(ies) are associated with the elimination of intercompany profits due to the sale of merchandise?

3.What elimination entry(ies) are necessary with the sale of equipment by Match to Pipe?

4.What elimination entry(ies) are associated with the note to Match? Why are the entry(ies) made?

Correct Answer:

Verified

Q20: On January 1, 20X1, Poe Corp. sold

Q20: Emron Company owns a 100% interest in

Q21: On January 1, 20X1, Parent Company acquired

Q22: On January 1, 20X1, Parent Company acquired

Q23: On January 1, 20X1, Pep Company acquired

Q24: Selected information from the separate and consolidated

Q25: On January 1, 20X1, Pinto Company purchased

Q26: On January 1, 20X1, Prange Company acquired

Q27: On January 1, 20X1, Prange Company acquired

Q42: For each of the following intercompany transactions,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents