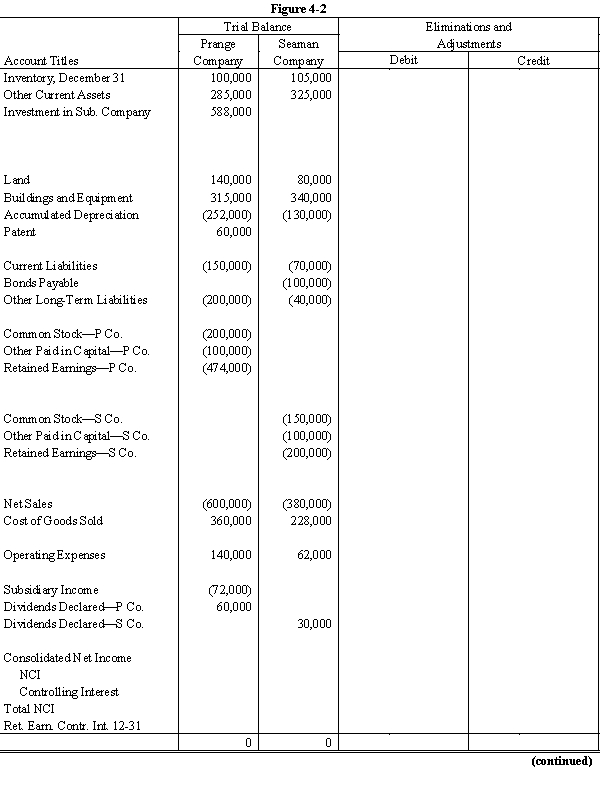

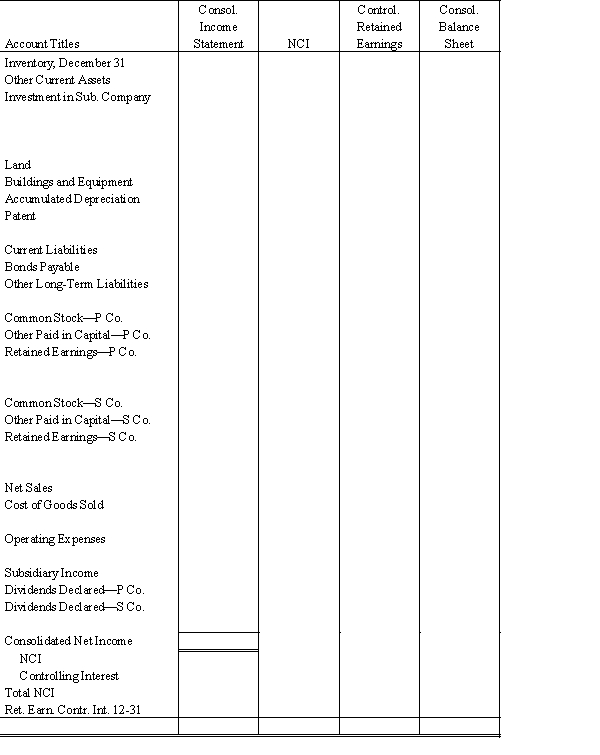

On January 1, 20X1, Prange Company acquired 80% of the common stock of Seaman Company for $500,000. On this date Seaman had total owners' equity of $400,000. Any excess of cost over book value is attributable to patent, which is to be amortized over 20 years.

During 20X1 and 20X2, Prange has appropriately accounted for its investment in Seaman using the simple equity method.

On January 1, 20X2, Prange held merchandise acquired from Seaman for $30,000. During 20X2, Seaman sold merchandise to Prange for $100,000, of which $20,000 is held by Prange on December 31, 20X2. Seaman's gross profit on all sales is 40%.

On December 31, 20X2, Prange still owes Seaman $20,000 for merchandise acquired in December.

Required:

Complete the Figure 4-2 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: On January 1, 20X1, Poe Corp. sold

Q20: Emron Company owns a 100% interest in

Q21: On January 1, 20X1, Parent Company acquired

Q22: On January 1, 20X1, Parent Company acquired

Q23: On January 1, 20X1, Pep Company acquired

Q24: Selected information from the separate and consolidated

Q25: On January 1, 20X1, Pinto Company purchased

Q26: On January 1, 20X1, Prange Company acquired

Q28: Account balances are as of December 31,

Q42: For each of the following intercompany transactions,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents