On January 1, 20X1, Pinto Company purchased an 80% interest in Sands Inc. for $1,000,000. The equity balances of Sands at the time of the purchase were as follows:

Any excess of cost over book value is attributable to goodwill.

Any excess of cost over book value is attributable to goodwill.

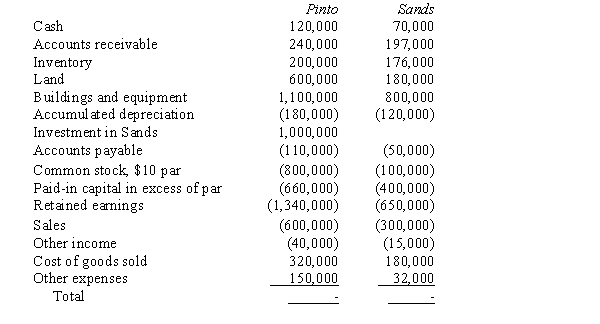

No dividends were paid by either firm during 20X6. The following trial balances were prepared for Pinto Company and its subsidiary, Sands Inc., on December 31, 20X6:

Sands sold a machine to Pinto Company for $40,000 on January 1, 20X6. The machine cost Sands $50,000, and $25,000 of accumulated depreciation had been recorded as of the sale date. The machine had a 5-year remaining life and no salvage value. Pinto Company is using straight-line depreciation.

Sands sold a machine to Pinto Company for $40,000 on January 1, 20X6. The machine cost Sands $50,000, and $25,000 of accumulated depreciation had been recorded as of the sale date. The machine had a 5-year remaining life and no salvage value. Pinto Company is using straight-line depreciation.

Since the purchase date, Pinto has sold merchandise for resale to Sands, Inc. at a mark-up on cost of 25%. Sales during 20X6 were $150,000. The inventory of these goods held by Sands was $15,000 on January 1, 20X6, and $18,000 on December 31, 20X6.

Required:

Prepare a consolidated income statement for 20X6, including income distribution schedules to support your distribution of income to the noncontrolling and controlling interest interests.

Correct Answer:

Verified

Q20: On January 1, 20X1, Poe Corp. sold

Q20: Emron Company owns a 100% interest in

Q21: On January 1, 20X1, Parent Company acquired

Q22: On January 1, 20X1, Parent Company acquired

Q23: On January 1, 20X1, Pep Company acquired

Q24: Selected information from the separate and consolidated

Q26: On January 1, 20X1, Prange Company acquired

Q27: On January 1, 20X1, Prange Company acquired

Q28: Account balances are as of December 31,

Q42: For each of the following intercompany transactions,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents