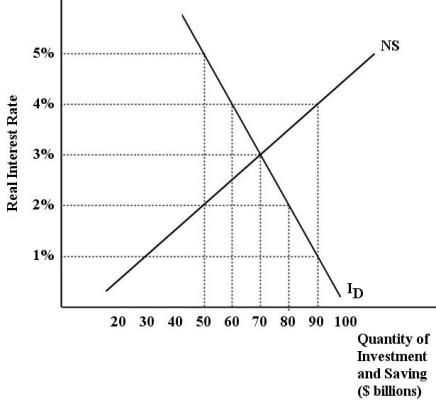

The diagram below shows the market for financial capital in the long run when real GDP is equal to potential output,Y*.  FIGURE 25-3

FIGURE 25-3

-Refer to Figure 25-3.Suppose the interest rate in this market for financial capital is 2%.Which of the following statements correctly describes the adjustment that will occur in this market?

A) The excess supply of saving will push up the real interest rate,which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

B) The excess demand for investment will push up the real interest rate,which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

C) The excess supply of saving will push down the real interest rate,which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

D) The excess demand for investment will push down the real interest rate,which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

E) The excess demand for investment will push up the real interest rate,which will increase the quantity demanded of investment and decrease the quantity supplied of saving.

Correct Answer:

Verified

Q61: The Neoclassical growth model assumes that,with a

Q64: The Neoclassical growth model assumes that,with a

Q65: In the Neoclassical growth model,decreases in the

Q70: The main properties of a Neoclassical aggregate

Q72: The diagram below shows the market for

Q73: The diagram below show the market for

Q78: The diagram below show the market for

Q79: Data from most industrialized countries show that

Q91: According to the Neoclassical growth model,it is

Q100: Neoclassical growth theory is based on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents