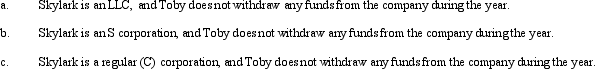

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Correct Answer:

Verified

Q65: Which of the following statements is correct

Q74: Eagle Corporation owns stock in Hawk Corporation

Q77: In order to induce Yellow Corporation to

Q79: Adam transfers cash of $300,000 and land

Q85: Trish and Ron form Pine Corporation. Trish

Q114: Nancy Smith is the sole shareholder and

Q117: Amber Company has $100,000 in net income

Q121: Adrian is the president and sole shareholder

Q122: Compare the basic tax and nontax factors

Q123: Almond Corporation,a calendar year C corporation,had taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents