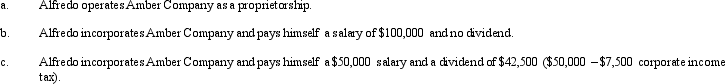

Amber Company has $100,000 in net income in 2013 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 33% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Correct Answer:

Verified

Q65: Which of the following statements is correct

Q74: Leah transfers equipment (basis of $400,000 and

Q74: Eagle Corporation owns stock in Hawk Corporation

Q77: In order to induce Yellow Corporation to

Q78: Orange Corporation owns stock in White Corporation

Q79: Adam transfers cash of $300,000 and land

Q85: Trish and Ron form Pine Corporation. Trish

Q114: Nancy Smith is the sole shareholder and

Q119: During the current year,Skylark Company had operating

Q122: Compare the basic tax and nontax factors

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents