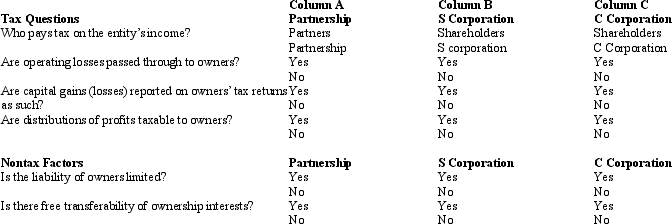

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Eagle Corporation owns stock in Hawk Corporation

Q77: In order to induce Yellow Corporation to

Q85: Trish and Ron form Pine Corporation. Trish

Q97: Penny, Miesha, and Sabrina transfer property to

Q117: Amber Company has $100,000 in net income

Q119: During the current year,Skylark Company had operating

Q121: Adrian is the president and sole shareholder

Q123: Almond Corporation,a calendar year C corporation,had taxable

Q125: During the current year,Coyote Corporation (a calendar

Q127: Tan Corporation desires to set up a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents