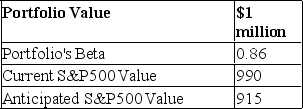

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

A) Sell 3.477

B) Buy 3.477

C) Sell 4.236

D) Buy 4.236

Correct Answer:

Verified

Q41: If interest rate parity holds,

A)covered interest arbitrage

Q43: If covered interest arbitrage opportunities exist,

A)interest rate

Q44: You are given the following information about

Q45: You are given the following information about

Q46: The most common short-term interest rate used

Q47: If covered interest arbitrage opportunities do not

Q48: You are given the following information about

Q48: A hedge ratio can be computed as

A)

Q49: Covered interest arbitrage

A)ensures that currency futures prices

Q50: If interest rate parity does not hold,

A)covered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents