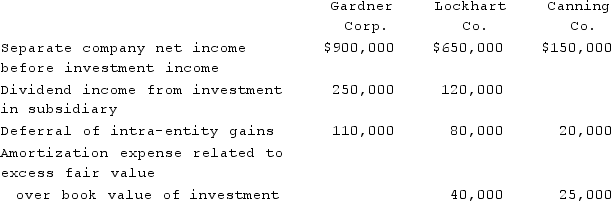

Gardner Corp. owns 80% of the voting common stock of Lockhart Co. Lockhart owns 70% of Canning Co. Gardner and Lockhart both use the initial value method to account for their investments. The following information is available from the financial statements and records of the three companies:  Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.What amount should be reported for consolidated net income?

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.What amount should be reported for consolidated net income?

A) $1,425,000.

B) $1,490,000.

C) $1,525,000.

D) $1,635,000.

E) $1,700,000.

Correct Answer:

Verified

Q1: D Corp. had investments, direct and indirect,

Q2: Buckette Co. owned 60% of Shuvelle Corp.

Q3: On January 1, 2021, a subsidiary bought

Q5: Beagle Co. owned 80% of Maroon Corp.

Q6: Evanston Co. owned 60% of Montgomery Corp.

Q7: Florrick Co. owns 85% of Bishop Inc.

Q8: Florrick Co. owns 85% of Bishop Inc.

Q9: Florrick Co. owns 85% of Bishop Inc.

Q10: In a tax-free business combination,

A) The income

Q11: Florrick Co. owns 85% of Bishop Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents