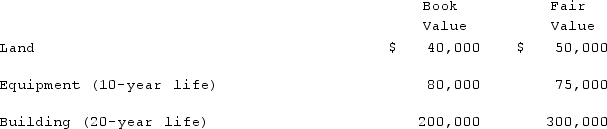

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2022, assuming the book value of the equipment at that date is still $80,000?

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2022, assuming the book value of the equipment at that date is still $80,000?

A) $70,000.

B) $73,500.

C) $75,000.

D) $76,500.

E) $80,000.

Correct Answer:

Verified

Q92: When is a goodwill impairment loss recognized?

A)

Q93: Hanson Co. acquired all of the common

Q94: With respect to the recognition of goodwill

Q95: Watkins, Inc. acquires all of the outstanding

Q96: Watkins, Inc. acquires all of the outstanding

Q98: Prince Company acquires Duchess, Inc. on January

Q99: According to the FASB ASC regarding the

Q100: Jaynes Inc. acquired all of Aaron Co.'s

Q101: Matthews Co. acquired all of the common

Q102: On 1/1/19, Sey Mold Corporation acquired 100%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents