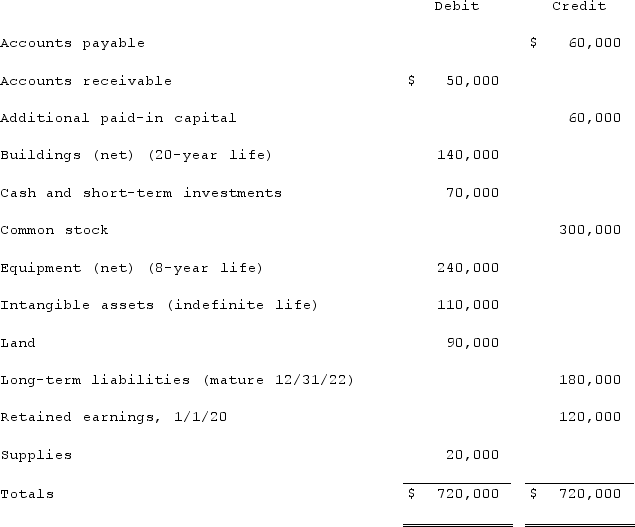

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2020. As of that date, Jackson had the following trial balance:  During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.) Prepare consolidation worksheet entries for December 31, 2020.(B.) Prepare consolidation worksheet entries for December 31, 2021.

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.) Prepare consolidation worksheet entries for December 31, 2020.(B.) Prepare consolidation worksheet entries for December 31, 2021.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Watkins, Inc. acquires all of the outstanding

Q97: Watkins, Inc. acquires all of the outstanding

Q98: Prince Company acquires Duchess, Inc. on January

Q99: According to the FASB ASC regarding the

Q100: Jaynes Inc. acquired all of Aaron Co.'s

Q102: On 1/1/19, Sey Mold Corporation acquired 100%

Q103: For an acquisition when the subsidiary maintains

Q104: How does the parent's choice of investment

Q105: On January 1, 2019, Rand Corp. issued

Q106: Paperless Co. acquired Sheetless Co. and in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents