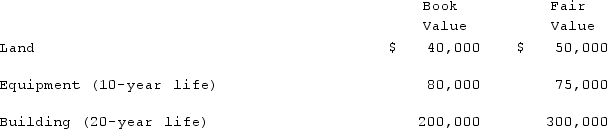

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2020, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2020?

If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2020, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2020?

A) $20,000 under the initial value method.

B) $30,000 under the partial equity method.

C) $50,000 under the partial equity method.

D) $44,500 under the equity method.

E) $45,500 regardless of the internal accounting method used.

Correct Answer:

Verified

Q91: Jaynes Inc. acquired all of Aaron Co.'s

Q92: When is a goodwill impairment loss recognized?

A)

Q93: Hanson Co. acquired all of the common

Q94: With respect to the recognition of goodwill

Q95: Watkins, Inc. acquires all of the outstanding

Q97: Watkins, Inc. acquires all of the outstanding

Q98: Prince Company acquires Duchess, Inc. on January

Q99: According to the FASB ASC regarding the

Q100: Jaynes Inc. acquired all of Aaron Co.'s

Q101: Matthews Co. acquired all of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents