An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

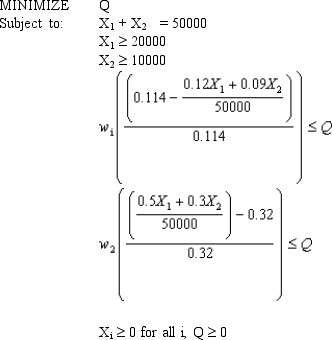

The following Excel spreadsheet has been created to solve a goal programming problem with a MINIMAX objective based on the following goal programming formulation with MINIMAX objective and corresponding solution.

with solution (X1, X2) = (15,370, 34,630).

with solution (X1, X2) = (15,370, 34,630).

What values should go in cells B2:D14 of the spreadsheet?

Correct Answer:

Verified

Q49: A dietician wants to formulate a

Q50: A company makes 2 products A

Q51: An investor wants to invest $50,000

Q52: An investor wants to invest $50,000

Q54: An investor wants to invest $50,000

Q55: A company wants to purchase large

Q56: A company wants to purchase large

Q57: A dietician wants to formulate a

Q61: Exhibit 7.4

The following questions are based on

Q71: Exhibit 7.4

The following questions are based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents