Van and Shapiro formed a partnership. As part of the formation, Van contributed equipment whose cost to her was $60,000, with accumulated depreciation for tax purposes of $36,000. The fair value of the equipment was $40,000. The partnership assumed $10,000 of Shapiro's personal debts when she was admitted into the partnership.

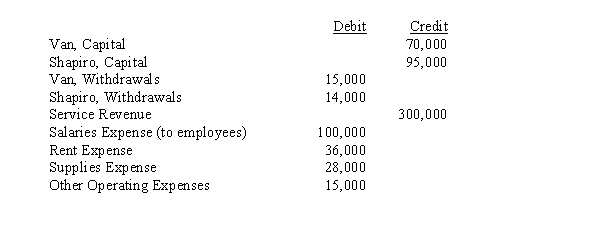

After one year of operation, the partnership had the following partial trial balance:

Partners split profits as follows:

(1)A salary of $30,000 is paid to Van.

(2)Remaining profits (or losses) are split 40% to Van, the remainder to Shapiro.

Required:

Calculate the two partners' ending capital balances.

Correct Answer:

Verified

Q35: Which of the following statements is true

Q36: Matt and Jeff organized their partnership on

Q37: Partners active in a partnership business should

Q38: Carey and Drew formed a partnership on

Q39: Olsen and Katch organized the OK Partnership

Q40: Partners Tuba and Drum share profits and

Q41: There are several differences between a partnership

Q42: Turner, Ike, and Gibson formed a partnership

Q43: Barnes and Noble, both lawyers, have decided

Q44: Cable and Jones are considering forming a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents