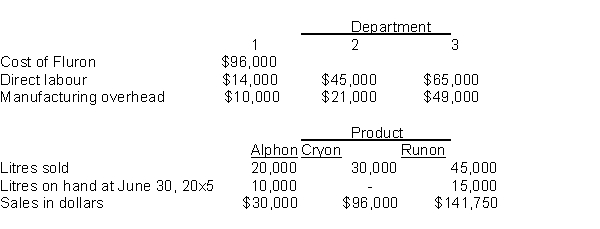

Johnson Manufacturing Company buys Fluron for $0.80 per litre. At the end of processing in Department 1, Fluron splits off into products Alphon, Cryon, and Runon. Alphon is sold at the split-off point, with no further processing. Cryon and Runon require further processing before they can be sold. Cryon is processed in Department 2 and Runon is processed in Department 3. Following is a summary of costs and other related data for the year ended June 30, 20x5:  There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All litres on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

There were no inventories on hand at July 1, 20x4, and there was no Fluron on hand at June 30, 20x5. All litres on hand at June 30, 20x5 were complete as to processing. Johnson uses the net realizable value method of allocating joint costs.

The value of the ending inventory for Alphon is:

A) $24,000

B) $12,000

C) $8,000

D) $13,333

Correct Answer:

Verified

Q111: The split-off point is:

A) The point at

Q112: By-products are:

I. Products of a joint process

Q113: Under the constant gross margin NRV method:

I.

Q114: The following are joint costs in the

Q115: The Great Foods Company processes milk into

Q116: Main products have a:

A) Net realizable value

Q117: Separable costs are:

A) The costs incurred after

Q118: The physical output method of joint product

Q119: The revenue from by-products may be recognized

I.

Q120: Johnson Manufacturing Company buys Fluron for $0.80

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents