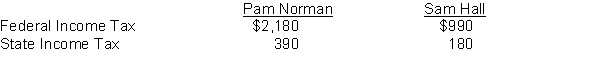

Pam Norman had earned (accumulated) salary of $96,000 through November 30. Her December salary amounted to $8,500. Sam Hall began employment on December 1 and will be paid his first month's salary of $5,000 on December 31. Income tax withholding for December for each employee is as follows:

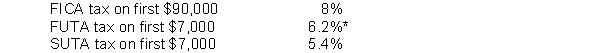

The following payroll tax rates are applicable:

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Correct Answer:

Verified

Q181: Donna Grace earns a salary of $8,000

Q182: Employee earnings records for Shoemaker Company reveal

Q183: In March, gross earnings of Ransey Company

Q184: Golf Pro Publications publishes a golf magazine

Q185: Assume that the payroll records of Darby

Q187: The following payroll liability accounts are included

Q190: Haney Company's payroll for the week ending

Q191: Hiatt Company had the following payroll data

Q204: A current liability is a debt that

Q209: Sales taxes collected from customers are a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents