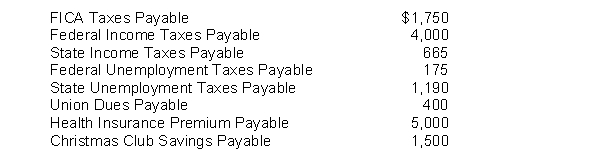

The following payroll liability accounts are included in the ledger of Eckstrom Company on January 1, 2010:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,750 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Sent a $1,500 check to a Savings and Loan for the Christmas Club withholdings.

Instructions

Journalize the January transactions

Correct Answer:

Verified

Q182: Employee earnings records for Shoemaker Company reveal

Q183: In March, gross earnings of Ransey Company

Q184: Golf Pro Publications publishes a golf magazine

Q185: Assume that the payroll records of Darby

Q186: Pam Norman had earned (accumulated) salary of

Q190: Haney Company's payroll for the week ending

Q191: Hiatt Company had the following payroll data

Q192: Foster Company is preparing adjusting entries at

Q204: A current liability is a debt that

Q209: Sales taxes collected from customers are a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents