Exhibit 20-4

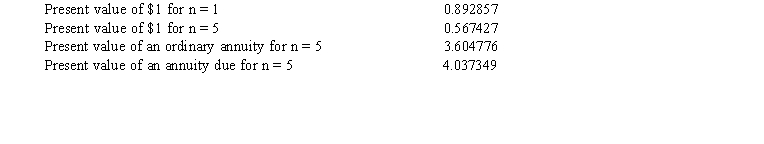

On January 1, 2016, Average Leasing Company entered into a direct financing lease with a lessee, Lenny Company. The lease agreement calls for five equal annual payments of $75,000 at the beginning of each year with the first payment due on January 1, 2016. The leased property has an estimated residual value of $10,000, which Lenny does not guarantee. The property remains the property of Average at the end of the lease term. Average desires a 12% rate of return. Present value factors for a 12% interest rate are as follows:

-Refer to Exhibit 20-4. What is the cost of the leased property to Average round the answer to the nearest dollar) ?

A) $308,475

B) $302,801

C) $276,032

D) $270,358

Correct Answer:

Verified

Q65: Any initial direct costs incurred by the

Q81: In a direct-financing lease, the lessor:

A) does

Q83: Exhibit 20-5

The Baltimore, Inc. entered into a

Q83: Any initial direct costs incurred by the

Q84: Depreciation expense will be recorded in the

Q85: Which of the following facts would preclude

Q87: Exhibit 20-4

On January 1, 2016, Average Leasing

Q88: Exhibit 20-5

The Baltimore, Inc. entered into a

Q89: On January 1, 2016, Christopher Properties sold

Q96: When a lessor receives cash on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents