Exhibit 20-5

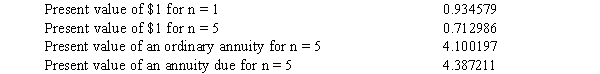

The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2016. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2016. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2020. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7%

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, what is the correct amount of interest revenue to be recognized by Baltimore for 2016 round the answer to the nearest dollar) ?

A) $7,774

B) $7,175

C) $6,527

D) $5,928

Correct Answer:

Verified

Q65: Any initial direct costs incurred by the

Q83: Exhibit 20-5

The Baltimore, Inc. entered into a

Q84: Depreciation expense will be recorded in the

Q85: Which of the following facts would preclude

Q86: Exhibit 20-4

On January 1, 2016, Average Leasing

Q87: Exhibit 20-4

On January 1, 2016, Average Leasing

Q89: On January 1, 2016, Christopher Properties sold

Q92: Exhibit 20-5

The Baltimore, Inc. entered into a

Q93: A six-year operating lease requires annual rent

Q96: When a lessor receives cash on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents