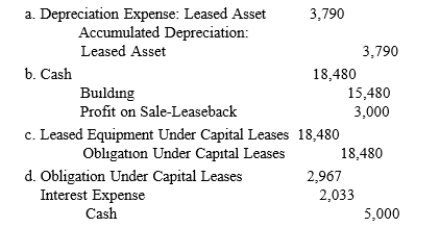

On January 1, 2016, Christopher Properties sold a building to another company and immediately leased it back again. The Christopher' book value for the building was $15,480. The lease was for five years with $5,000 payable at the end of each year. The payments, discounted at 11%, equaled $18,480. Which entry would Christopher Properties not make in 2016?

Correct Answer:

Verified

Q65: Any initial direct costs incurred by the

Q84: Depreciation expense will be recorded in the

Q85: Which of the following facts would preclude

Q86: Exhibit 20-4

On January 1, 2016, Average Leasing

Q87: Exhibit 20-4

On January 1, 2016, Average Leasing

Q88: Exhibit 20-5

The Baltimore, Inc. entered into a

Q92: Exhibit 20-5

The Baltimore, Inc. entered into a

Q93: A six-year operating lease requires annual rent

Q94: Which of the following items should be

Q96: When a lessor receives cash on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents