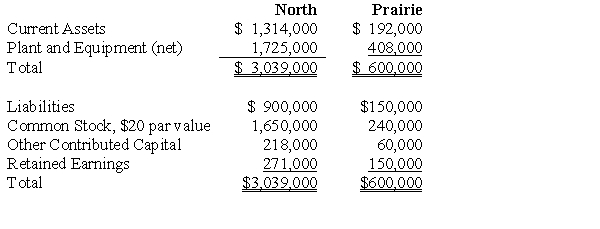

North Company issued 24,000 shares of its $20 par value common stock for the net assets of Prairie Company in business combination under which Prairie Company will be merged into North Company. On the date of the combination, North Company common stock had a fair value of $30 per share. Balance sheets for North Company and Prairie Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and the fair value of Prairie Company's current assets is $270,000, its plant and equipment is $726,000, and its liabilities are $168,000, North Company's financial statements immediately after the combination will include:

If the business combination is treated as an acquisition and the fair value of Prairie Company's current assets is $270,000, its plant and equipment is $726,000, and its liabilities are $168,000, North Company's financial statements immediately after the combination will include:

A) Negative goodwill of $108,000.

B) Plant and equipment of $2,133,000.

C) Plant and equipment of $2,343,000.

D) An ordinary gain of $108,000.

Correct Answer:

Verified

Q32: Maplewood Corporation purchased the net assets of

Q33: The fair value of net identifiable assets

Q34: The managers of Savage Company own 10,000

Q35: SFAS No. 142 requires that goodwill impairment

Q36: Posch Company issued 12,000 shares of its

Q37: Porpoise Corporation acquired Sims Company through an

Q38: On May 1, 2016, the Phil Company

Q40: P Company acquires all of the voting

Q41: On January 1, 2013, Brighton Company acquired

Q42: The following balance sheets were reported on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents