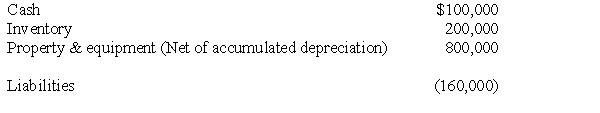

On May 1, 2016, the Phil Company paid $1,200,000 for 80% of the outstanding common stock of Sage Corporation in a transaction properly accounted for as an acquisition. The recorded assets and liabilities of Sage Corporation on May 1, 2016, follow:  On May 1, 2016, it was determined that the inventory of Sage had a fair value of $220,000 and the property and equipment (net) has a fair value of $1,200,000. What is the amount of goodwill resulting from the business combination?

On May 1, 2016, it was determined that the inventory of Sage had a fair value of $220,000 and the property and equipment (net) has a fair value of $1,200,000. What is the amount of goodwill resulting from the business combination?

A) $0.

B) $112,000.

C) $140,000.

D) $28,000.

Correct Answer:

Verified

Q32: Maplewood Corporation purchased the net assets of

Q33: The fair value of net identifiable assets

Q34: The managers of Savage Company own 10,000

Q35: SFAS No. 142 requires that goodwill impairment

Q36: Posch Company issued 12,000 shares of its

Q37: Porpoise Corporation acquired Sims Company through an

Q39: North Company issued 24,000 shares of its

Q40: P Company acquires all of the voting

Q41: On January 1, 2013, Brighton Company acquired

Q42: The following balance sheets were reported on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents