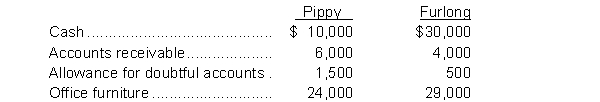

On January 1, 2013, Steve Furlong and Mark Pippy agreed to pool their assets and form a partnership called F&P Computing. They agree to share all profits equally and make the following initial investments:  On December 31, 2013, the partnership reported a loss for the year of $19,500. On January 1, 2014, Furlong and Pippy agreed to accept Nicholas Adams into the partnership by purchasing 20% of Pippy's interest in the partnership and 30% of Furlong's interest. The partnership agreement is amended to provide for the following sharing of profit and losses:

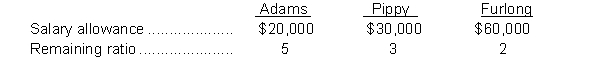

On December 31, 2013, the partnership reported a loss for the year of $19,500. On January 1, 2014, Furlong and Pippy agreed to accept Nicholas Adams into the partnership by purchasing 20% of Pippy's interest in the partnership and 30% of Furlong's interest. The partnership agreement is amended to provide for the following sharing of profit and losses:  For the year ended December 31, 2014, profit was $350,000.

For the year ended December 31, 2014, profit was $350,000.

Instructions

a. Journalize the following transactions:

(1) the initial contributions to the partnership by Furlong and Pippy on January 1, 2013.

(2) the allocation of the loss to the partners at the end of December 2013.

(3) the purchase of the partnership interest by Adams on January 1, 2014.

b. Prepare a schedule to show the division of profit at December 31, 2014.

Correct Answer:

Verified

Q101: The liquidation of a partnership

A) cannot be

Q122: Laroche, Kennedy, and White formed a partnership

Q123: A capital deficiency exists when

A) two or

Q124: Max Baer and Jimmy Choo are two

Q125: In the final step of the liquidation

Q128: Jim Steele and John Rich operate separate

Q129: Pac-link Technologies is a partnership owned and

Q130: Julie Harris, William Gosse, and Regina Ryan

Q131: Three types of partnerships were described in

Q132: Marty Cummerford and Jane Wheeler have formed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents