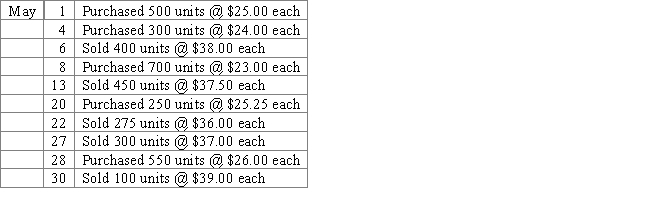

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.

-Using the table provided, calculate total sales, cost of goods sold, gross profit, and ending inventory using each of the average cost periodic inventory method. Round the average to the nearest cent.

A) Total sales: $56,975.00

Cost of goods sold: $36,431.25

Gross profit: $20,543.75

Ending inventory: $19,981.2

B) Total sales: $56,975.00

Cost of goods sold: $36,587.50

Gross profit: $20,387.50

Ending inventory: $19,825.00

C) Total sales: $56,975.00

Cost of goods sold: $37,312.50

Gross profit: $19,662.50

Ending inventory: $19,573.25

D) Total sales: $56,975.00

Cost of goods sold: $37,401.75

Gross profit: $19,573.25

Ending inventory: $19,010.75

Correct Answer:

Verified

Q190: Basic inventory data for April 30

Q191: Brutus Corporation, a newly formed corporation, has

Q192: During the taking of its physical inventory

Q193: The following data were taken from Castle,

Q194: Assume that three identical units of

Q196: Addison, Inc. uses a perpetual inventory system.

Q197: Brutus Corporation, a newly formed corporation, has

Q198: Applying the lower of cost or

Q199: Addison, Inc. uses a perpetual inventory system.

Q200: Brutus Corporation, a newly formed corporation, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents