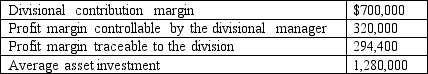

The following data pertain to the Ouster Division of Klandestine Company:

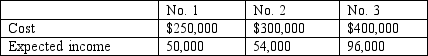

The company uses responsibility accounting concepts when evaluating performance; Ouster's division manager is contemplating the following three investments. He can invest up to $400,000.

Required:

A. Calculate the ROIs of the three investments.

B. What is the division manager's current ROI, computed by using responsibility accounting concepts?

C. Which of the three investments would be selected if the manager's focus is on Ouster's divisional performance, as judged by ROI? Why?

D. If Klandestine has an imputed interest charge of 22%, compute the residual income of investment no. 3. If Ouster's Division manager is evaluated by residual income, is this investment attractive from Ouster's perspective? From Klandestine's perspective? Why?

Correct Answer:

Verified

No. 2...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Return on investment (ROI) is a very

Q92: Sierra Corporation is a multi-divisional company whose

Q93: Roger Corporation produces goods in the United

Q94: The following data pertain to Napal Company

Q95: Compuwork Corporation is organized in three separate

Q96: Gamma Division of Fava Corporation produces electric

Q97: Return on investment (ROI) and residual income

Q99: Consider the following data of Twisted Corporation's

Q100: Valient, Inc. has a Pennsylvania-based division that

Q101: What are the three objectives of internal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents