Compuwork Corporation is organized in three separate divisions. The three divisional managers are evaluated at year-end, and bonuses are awarded based on ROI. Last year, the overall company produced a 12% return on its investment.

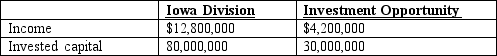

Managers of Compuwork's Iowa Division recently studied an investment opportunity that would assist in the division's future growth. Relevant data follow.

Required:

A. Compute the current ROI of the Iowa Division and the division's ROI if the investment opportunity is pursued.

B. What is the likely reaction of divisional management toward the acquisition? Why?

C. What is the likely reaction of Compuwork's corporate management toward the investment? Why?

D. Assume that Compuwork uses residual income to evaluate performance and desires an 11% minimum return on invested capital. Compute the current residual income of the Iowa Division and the division's residual income if the investment is made. Will divisional management likely change its attitude toward the acquisition? Why?

Correct Answer:

Verified

Curre...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Although the general rule for transfer prices

Q91: Return on investment (ROI) is a very

Q92: Sierra Corporation is a multi-divisional company whose

Q93: Roger Corporation produces goods in the United

Q94: The following data pertain to Napal Company

Q96: Gamma Division of Fava Corporation produces electric

Q97: Return on investment (ROI) and residual income

Q98: The following data pertain to the Ouster

Q99: Consider the following data of Twisted Corporation's

Q100: Valient, Inc. has a Pennsylvania-based division that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents