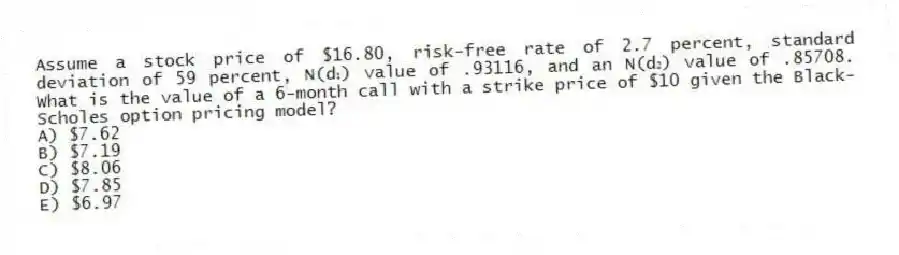

Assume a stock price of $16.80, risk-free rate of 2.7 percent, standard deviation of 59 percent, N(d₁) value of .93116, and an N(d₂) value of .85708. What is the value of a 6-month call with a strike price of $10 given the Black-Scholes option pricing model?

A) $7.62

B) $7.19

C) $8.06

D) $7.85

E) $6.97

Correct Answer:

Verified

Q67: Use the information below to answer the

Q68: Use the information below to answer the

Q69: Assume a stock price of $21.80, an

Q70: The delta of a call option on

Q71: Use the information below to answer the

Q73: A stock is currently priced at $38.

Q74: The current market value of the assets

Q75: Use the information below to answer the

Q76: A stock is currently selling for $39

Q77: Assume a stock price of $34.80, an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents