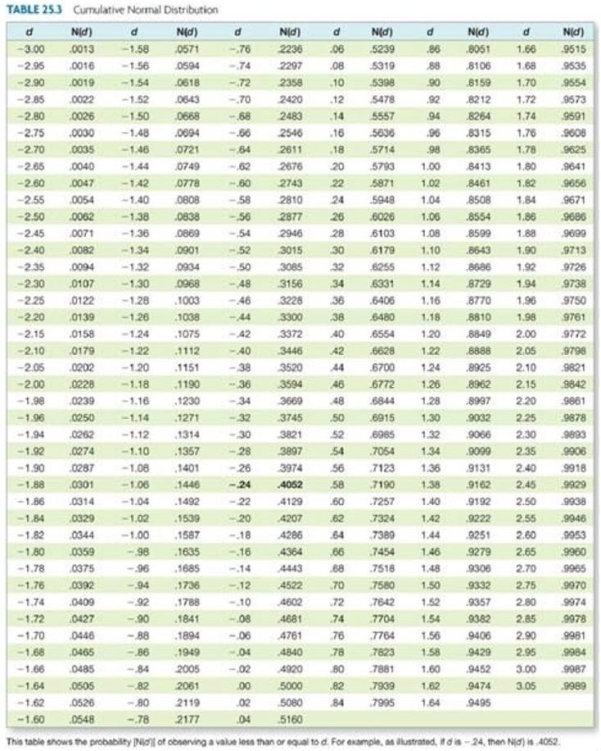

Use the information below to answer the following question.

Alpha is considering a purely financial merger with Beta. Alpha currently has a market value of $14 million, an asset return standard deviation of 55 percent, and pure discount debt of $6 million that matures in four years. Beta has a market value of $6 million, an asset return standard deviation of 60 percent, and pure discount debt of $2 million that matures in four years. The risk free rate, continuously compounded, is 3.5 percent. The combined equity value of the two separate firms is $14,180,806. By what amount will the combined equity value change if the merger occurs and the asset return standard deviation of the merged firm is 45 percent?

A) −$548,285

B) −$314,007

C) $0

D) $99,087

E) $286,403

Correct Answer:

Verified

Q63: A call option matures in six months.

Q64: The delta of a call option on

Q65: Use the information below to answer the

Q66: Use the information below to answer the

Q67: Use the information below to answer the

Q69: Assume a stock price of $21.80, an

Q70: The delta of a call option on

Q71: Use the information below to answer the

Q72: Assume a stock price of $16.80, risk-free

Q73: A stock is currently priced at $38.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents