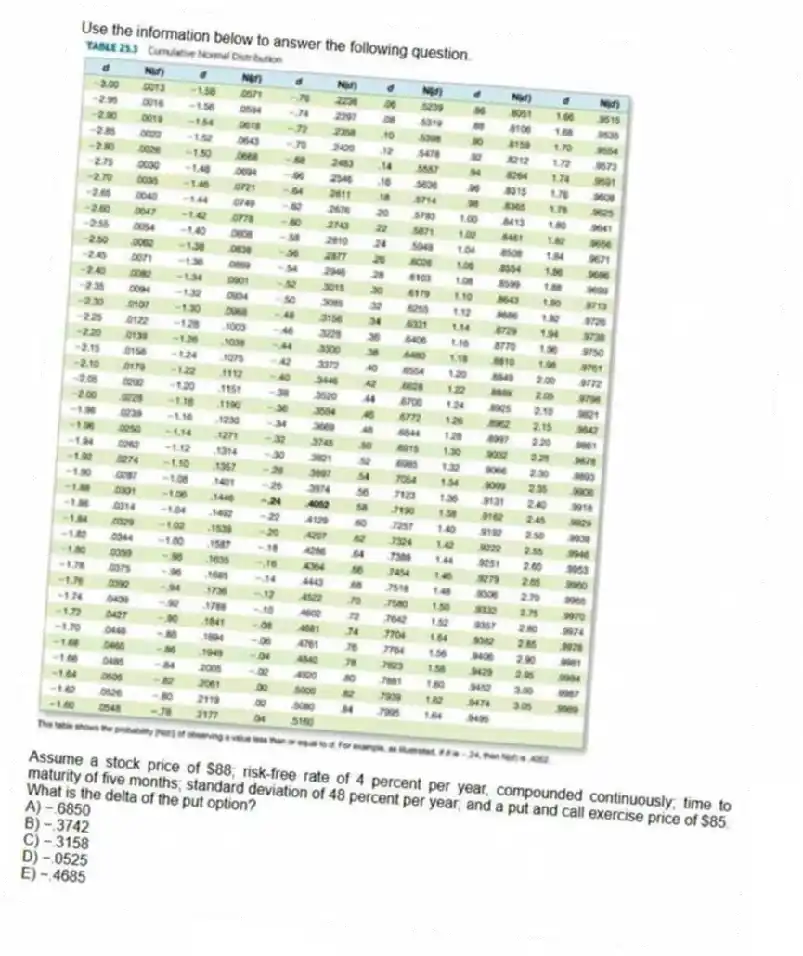

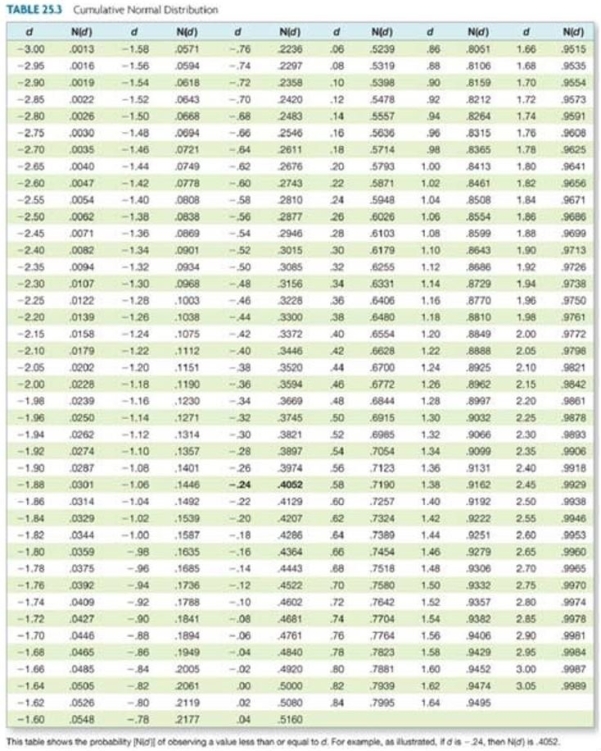

Use the information below to answer the following question.

Assume a stock price of $88; risk-free rate of 4 percent per year, compounded continuously; time to maturity of five months; standard deviation of 48 percent per year; and a put and call exercise price of $85. What is the delta of the put option?

A) −.6850

B) −.3742

C) −.3158

D) −.0525

E) −.4685

Correct Answer:

Verified

Q60: If the risk-free rate is 6.5 percent

Q61: A stock is priced at $52.90 a

Q62: A stock is currently selling for $34

Q63: A call option matures in six months.

Q64: The delta of a call option on

Q66: Use the information below to answer the

Q67: Use the information below to answer the

Q68: Use the information below to answer the

Q69: Assume a stock price of $21.80, an

Q70: The delta of a call option on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents