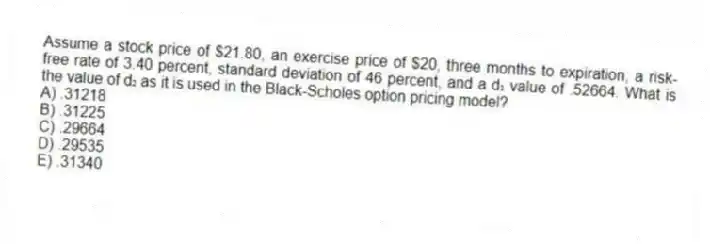

Assume a stock price of $21.80, an exercise price of $20, three months to expiration, a risk-free rate of 3.40 percent, standard deviation of 46 percent, and a d₁ value of .52664. What is the value of d₂ as it is used in the Black-Scholes option pricing model?

A) .31218

B) .31225

C) .29664

D) .29535

E) .31340

Correct Answer:

Verified

Q64: The delta of a call option on

Q65: Use the information below to answer the

Q66: Use the information below to answer the

Q67: Use the information below to answer the

Q68: Use the information below to answer the

Q70: The delta of a call option on

Q71: Use the information below to answer the

Q72: Assume a stock price of $16.80, risk-free

Q73: A stock is currently priced at $38.

Q74: The current market value of the assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents