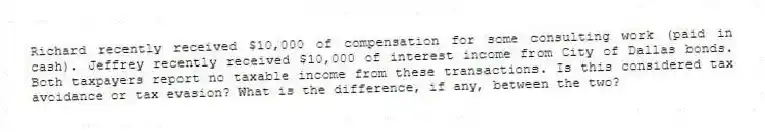

Richard recently received $10,000 of compensation for some consulting work (paid in cash). Jeffrey recently received $10,000 of interest income from City of Dallas bonds. Both taxpayers report no taxable income from these transactions. Is this considered tax avoidance or tax evasion? What is the difference, if any, between the two?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: The income shifting and timing strategies are

Q98: Paying "fabricated" expenses in high tax rate

Q99: An astute tax student once summarized that

Q100: If Tom invests $60,000 in a taxable

Q101: Antonella works for a company that pays

Q103: Boeing is considering opening a plant in

Q104: Troy is not a very astute investor.

Q105: Lucky owns a maid service that cleans

Q106: Rodney, a cash basis taxpayer, owes $40,000

Q107: Maurice is currently considering investing in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents