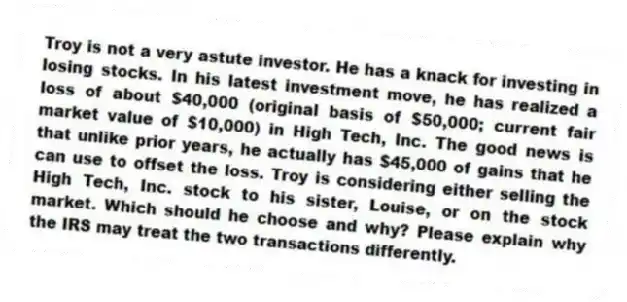

Troy is not a very astute investor. He has a knack for investing in losing stocks. In his latest investment move, he has realized a loss of about $40,000 (original basis of $50,000; current fair market value of $10,000) in High Tech, Inc. The good news is that unlike prior years, he actually has $45,000 of gains that he can use to offset the loss. Troy is considering either selling the High Tech, Inc. stock to his sister, Louise, or on the stock market. Which should he choose and why? Please explain why the IRS may treat the two transactions differently.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: An astute tax student once summarized that

Q100: If Tom invests $60,000 in a taxable

Q101: Antonella works for a company that pays

Q102: Richard recently received $10,000 of compensation for

Q103: Boeing is considering opening a plant in

Q105: Lucky owns a maid service that cleans

Q106: Rodney, a cash basis taxpayer, owes $40,000

Q107: Maurice is currently considering investing in a

Q108: Bono owns and operates a sole proprietorship

Q109: Sal, a calendar year taxpayer, uses the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents