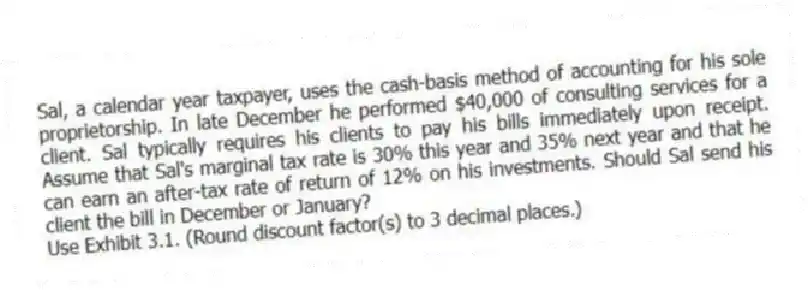

Sal, a calendar year taxpayer, uses the cash-basis method of accounting for his sole proprietorship. In late December he performed $40,000 of consulting services for a client. Sal typically requires his clients to pay his bills immediately upon receipt. Assume that Sal's marginal tax rate is 30% this year and 35% next year and that he can earn an after-tax rate of return of 12% on his investments. Should Sal send his client the bill in December or January?

Use Exhibit 3.1. (Round discount factor(s) to 3 decimal places.)

Correct Answer:

Verified

Option 1: Sen...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Troy is not a very astute investor.

Q105: Lucky owns a maid service that cleans

Q106: Rodney, a cash basis taxpayer, owes $40,000

Q107: Maurice is currently considering investing in a

Q108: Bono owns and operates a sole proprietorship

Q110: Susan Brown has decided that she would

Q111: O'Reilly is a masterful lottery player. The

Q112: Bobby and Whitney are husband and wife

Q113: Jayzee is a single taxpayer who operates

Q114: Joe Harry, a cash basis taxpayer, owes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents