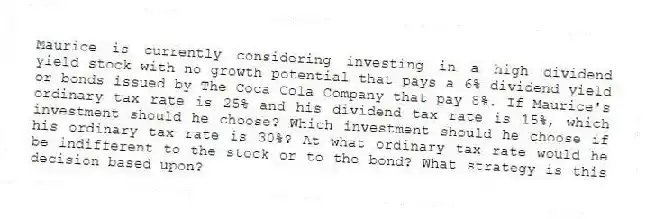

Maurice is currently considering investing in a high dividend yield stock with no growth potential that pays a 6% dividend yield or bonds issued by The Coca Cola Company that pay 8%. If Maurice's ordinary tax rate is 25% and his dividend tax rate is 15%, which investment should he choose? Which investment should he choose if his ordinary tax rate is 30%? At what ordinary tax rate would he be indifferent to the stock or to the bond? What strategy is this decision based upon?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Richard recently received $10,000 of compensation for

Q103: Boeing is considering opening a plant in

Q104: Troy is not a very astute investor.

Q105: Lucky owns a maid service that cleans

Q106: Rodney, a cash basis taxpayer, owes $40,000

Q108: Bono owns and operates a sole proprietorship

Q109: Sal, a calendar year taxpayer, uses the

Q110: Susan Brown has decided that she would

Q111: O'Reilly is a masterful lottery player. The

Q112: Bobby and Whitney are husband and wife

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents