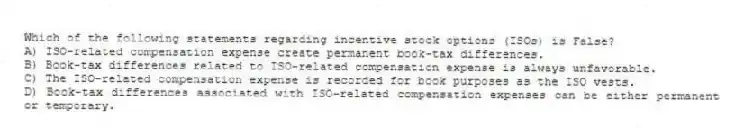

Which of the following statements regarding incentive stock options (ISOs) is False?

A) ISO-related compensation expense create permanent book-tax differences.

B) Book-tax differences related to ISO-related compensation expense is always unfavorable.

C) The ISO-related compensation expense is recorded for book purposes as the ISO vests.

D) Book-tax differences associated with ISO-related compensation expenses can be either permanent or temporary.

Correct Answer:

Verified

Q70: BTW Corporation has taxable income in the

Q71: Which of the following statements regarding capital

Q72: Which of the following statements regarding net

Q73: Orange Inc. issued 20,000 nonqualified stock options

Q74: Which of the following statements regarding the

Q75: Which of the following is not required

Q76: In January 2018, Khors Company issued nonqualified

Q79: Which of the following is allowable as

Q90: Studios reported a net capital loss of

Q98: Which of the following is deductible in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents