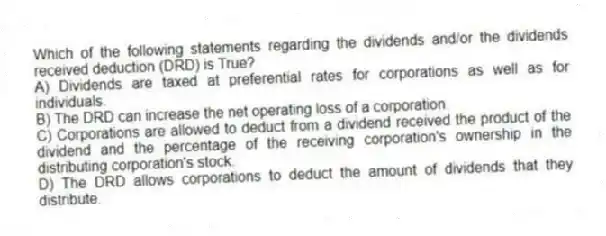

Which of the following statements regarding the dividends and/or the dividends received deduction (DRD) is True?

A) Dividends are taxed at preferential rates for corporations as well as for individuals.

B) The DRD can increase the net operating loss of a corporation.

C) Corporations are allowed to deduct from a dividend received the product of the dividend and the percentage of the receiving corporation's ownership in the distributing corporation's stock.

D) The DRD allows corporations to deduct the amount of dividends that they distribute.

Correct Answer:

Verified

Q69: For corporations, which of the following regarding

Q71: Which of the following statements regarding capital

Q72: Which of the following statements regarding net

Q73: Orange Inc. issued 20,000 nonqualified stock options

Q75: Which of the following statements regarding incentive

Q75: Which of the following is not required

Q76: In January 2018, Khors Company issued nonqualified

Q79: Which of the following is allowable as

Q90: Studios reported a net capital loss of

Q98: Which of the following is deductible in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents